What is utility bill management? Basically, utility bill management is the streamlining of utility expense management — including electricity, gas, water, waste removal, telecommunications, and other utility accounts.

Managing utility bills can be a huge hassle for enterprise companies. Each location will have multiple utilities, and you’ll increase your number of vendors and resources as you add more sites. This will increase the time and money it takes to manage everything.

So what can be done to streamline processing, improve validation, and simplify payments?

Outsourcing utility expense management is a widely accepted, effective approach to managing several non-core business functions. It is a common practice for organizations to outsource the management of buildings, facilities, energy efficiency, and sustainability data collection.

Table of Contents

- Utility Expense Management Overview

- What is a Utility Expense Management Service?

- What Does a Utility Expense Management Service Do?

- How to Keep Utility Expenses Down

- Get Energy-Efficient Appliances

- Educate Yourself on Energy Saving Practices

- Consider Alternative Energy Sources

- Shop Around for the Best Rates

- Stay on Top of Maintenance

- Seek Professional Help When Needed

- Frequently Asked Questions

- What is an example of a utility expense?

- How do you record utility expenses?

- Is utility expenses an asset or liability?

- Conclusion

Utility Expense Management Overview

Most businesses now outsource almost all of these services to third-party vendors.

The accounts payable department is often outside the traditional scope of outsourced work, as handling the company’s financials is such an important part of its operations. However, when dealing with a large number of vendors and processing payments of bills with such a short turnaround time, companies have found a different solution.

According to a survey of 1,000 businesses, 75% of companies spend between $7.75 and $12.44 for processing a single invoice. This does not, however, include other costs such as late payment penalties, service interruptions, or interest.

By outsourcing your utility bill management, you can cut your costs by up to 60% with a service that eliminates all late payments and disconnections.

Best of all, you no longer need to manage multiple utility accounts and pay their separate fees. Now, you only need to pay one vendor, and that’s it!

What is a Utility Expense Management Service?

A utility bill management service offers businesses a software solution for billing and payment. This platform allows companies to manage all of their utilities in one system.

The efficiency that account management and tracking systems provide is immense. A single resource can manage thousands, or even tens of thousands of customers, all from the comfort of their desks.

What Does a Utility Expense Management Service Do?

- Automate the direct collection of invoices from all utilities such as electricity, gas, waste, water, sewer, and telecom.

- Scan and input 100% of data from each invoice within 48 hours.

- Process bills on a first-due-first-through process, which means no more late fees.

- Find missing invoices and process them before the due date.

- Validate all invoices for payment.

- Manage occupancy changes with the utilities.

- Create custom funding files for integration with AP systems.

- Automate payment of utility companies through ACH or RPPS.

- Track Utility deposits.

- Utility budgeting.

- Create custom reports

- Display PDF invoices on-screen with a multiple-metrics dashboard.

Most utility companies will evaluate your business to see if you are a good fit. They will then offer you a free demonstration and a customized quote.

How to Keep Utility Expenses Down

(Source)

1. Get Energy-Efficient Appliances

If your fridge is from the 1970s, it’s time for an upgrade! Energy-efficient appliances use less electricity and water, which means lower utility charges for you.

2. Educate Yourself on Energy Saving Practices

There are lots of simple things you can do to save energy around the house – from turning off lights when you leave a room to unplugging electronics that aren’t in use.

A little research goes a long way toward reducing your carbon footprint AND saving money on utilities.

3. Consider Alternative Energy Sources

If you are located in a city with lots of sun, wind, or water, you may be able to save money by using alternative energy sources like solar panels or wind turbines. These options can be expensive to install but the long-term savings can be significant.

4. Shop Around for the Best Rates

Utility companies often offer discounts for things like signing up for automatic billing or using paperless statements. It pays to shop around and see what deals are available.

5. Stay on Top of Maintenance

Regularly cleaning and maintenance can help your appliances run more efficiently and prevent costly repairs down the road.

Establish a Budget

If you want to get a handle on your finances, it’s important to have a budget in place.

One of the key components of any budget is managing your utility expenses. This can be a challenge since utilities can fluctuate month to month.

But there are some steps you can take to keep your utility costs under control.

Here are a few tips for utility bill management.

1. Know Your Usage Patterns

Take a look at your past utility invoices to get an idea of how much you typically use each month. This will help you estimate your costs going forward.

2. Take Advantage of Discounts

Many utility companies offer discounts for energy-efficiency upgrades or paying your bill on time.

3. Stay On Top Of Your Payments

One of the best ways to avoid late fees and other penalties is to make your utility payments on time. You can set up automatic payments to make things easier.

Review Your Expenses Regularly

Utility expenses can be a big drain on your budget. By taking a close look at your utility expenses, you can find ways to cut back and save money.

Here are a few tips.

1. Review Your Energy Usage

Do you really need to keep the heat on all day?

Could you turn it down a few degrees and save on your energy bill?

2. Negotiate With Your Current Provider

If you’re happy with your current utility providers, don’t be afraid to negotiate for a better rate. It never hurts to ask, and you could save a lot of money.

5. Review Your Expenses Regularly

The best way to save money on your utility expenses is to review them regularly. By taking a close look at where your money is going, you can find ways to cut back and save.

Invest in Energy-Efficient Appliances and Systems

If you want to save money on your utility bills, one of the best things you can do is invest in energy-efficient appliances and systems. By making these types of investments, you’ll be able to reduce your energy consumption and save money in the long run.

One of the most important things to consider when choosing energy-efficient appliances is the initial cost.

While it’s true that you’ll save money on your utility bills by using less energy, you also need to make sure that the appliance will pay for itself over time.

Luckily, there are a number of tax credits and other incentives available to help offset the initial cost of energy-efficient appliances.

When it comes to choosing energy-efficient systems, it’s important to consider the long-term costs as well. Many energy-efficient systems require a higher initial investment, but they also tend to have lower operating costs over time.

This means that you’ll save money on your utility bills in the long run. If you’re looking for ways to save money on your utility bills, investing in energy-efficient appliances and systems is a great place to start.

Educate Yourself on Utility Rates and Services

Utility bill management is important for any business or homeowner. By understanding utility rates and services, you can make informed decisions about your energy use.

What are some tips for understanding utility rates and services?

1. Understand Fees and Charges

Read the fine print so you understand all the fees and charges associated with your utility service.

2. Manage Your Account

Stay on top of your account to make sure you are being billed correctly.

3. Know Your Rights

Familiarize yourself with your rights as a utility customer.

Seek Professional Help When Needed

There are a lot of things in life that we can do on our own. But there are also times when we need to seek professional help.

This is especially true when it comes to managing our finances. If you’re not sure how to keep track of your expenses or how to budget your money, it might be time to seek professional help from utility experts.

There are many financial advisors and counselors who can help you get your finances in order. And if you have a lot of debts, there are also companies that specialize in debt management.

Don’t be afraid to seek professional help when it comes to managing your finances. Energy savings can make a big difference in your life.

Frequently Asked Questions

What is an example of a utility expense?

A utility expense is a bill for the use of public utilities, such as electricity, water, or gas.

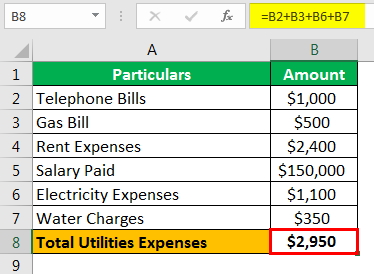

How do you record utility expenses?

Utility expenses can be recorded by tracking the bills received from the utility company. This can be done manually or by using accounting software.

The bills should be tracked in a way that allows you to see how much was spent on each utility, as well as when the bill was paid. This will help you to keep track of your spending and budget for future expenses.

Is utility expenses an asset or liability?

Utility expenses are a liability.

Conclusion

By following these utility expense management tips, you can effectively track your utility expenses and keep costs low. Stay on top of maintenance, shop around for the best rates, and consider alternative energy sources to save money in the long run.