ESG investing is a type of investment that focuses on environmental, social, and governance factors. Why is ESG important for companies?

Many people believe that ESG investing will save the world because it takes into account factors that are important to society such as climate change and income inequality. Companies can be more sustainable if they focus on long-term growth rather than short-term profits.

So, why is ESG important for companies? In short, implementing an ESG strategy can help companies improve their bottom line while also benefiting society.

Table of Contents

What is ESG?

ESG is a set of standards used by investors to evaluate companies’ performances on issues relating to the environment, social responsibility, and corporate governance.

ESG has become an important factor in investment decision-making as more and more investors are incorporating these considerations into their investment analysis.

A growing body of evidence suggests that companies with strong ESG practices tend to outperform those without them.

There are a number of reasons why is ESG important for companies.

For one, it is increasingly becoming a factor in investment decisions. More and more investors are incorporating ESG considerations into their decision-making and, as a result, companies with strong ESG practices tend to outperform those without them.

Additionally, strong ESG practices can help companies attract and retain talent, as employees are increasingly looking to work for companies that are aligned with their values.

Moreover, good ESG practices can help companies mitigate risk and build resilience, as they are often associated with better management of environmental and social issues.

Finally, ESG can be a source of competitive advantage for companies. Those that are able to effectively integrate ESG considerations into their strategy and operations are well-positioned to win over customers and investors.

Thus, there are a number of reasons why is ESG important for companies. Those that are able to effectively integrate these considerations into their strategy and operations are likely to find themselves at a competitive advantage.

ESG and Corporate Social Responsibility

ESG is not the same as corporate social responsibility. CSR and ESG may be related but they’re very different concepts.

Corporate Social Responsibility is a business strategy that forces businesses to implement social programs that benefit the community while boosting profits. ESG, meanwhile, is a set of criteria that assesses a corporation’s social responsibility.

CSR provides businesses with the vision and mission to be accountable for their sustainability and social responsibility agendas, while ESG lays out the standards for how to measure corporate social and environmental responsibility.

To simplify, CSR is the qualitative side of social responsibility while ESG is the quantitative aspect.

The Importance of Incorporating ESG into Business Strategy

Why is ESG important for companies?

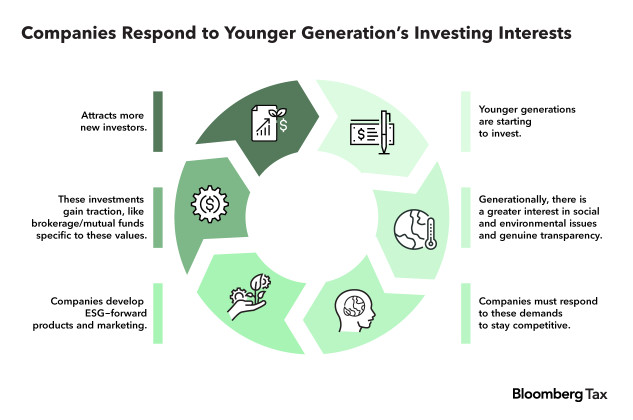

As more and more companies are looking to “do good” and have a positive impact on both society and the environment, the concept of ESG (environmental, social, and governance) has become increasingly important.

There are numerous reasons why a company might want to consider ESG when making decisions.

For one, it’s simply good business. More and more consumers are interested in supporting companies that are sustainable and have a positive impact on the world.

Incorporating ESG into business strategy can also help companies reduce risk and increase opportunities. For example, by mitigating environmental risks, a company can protect itself from potentially costly regulations in the future.

Additionally, by investing in sustainable practices, a company can position itself to take advantage of the growing market for green products and services.

(Source)

Is ESG for Businesses of All Sizes?

While large companies can afford to have a team dedicated to their environmental, social, and governance (ESG) initiatives, smaller companies can still benefit by improving their ability to make decisions quickly, improve flexibility, and get closer to customers.

Switching to eco-friendly practices such as using green packaging and electronic billing, and making use of renewable energy sources, are small steps that can significantly reduce your businesses’ impact on the environment.

As more investments are made in companies that adhere to strong environmental, social, and governance (ESG) practices, small and medium-sized businesses (SMB) that have strong sustainability programs will be more likely to attract the interest of potential investors. Having a strong focus on sustainable business practices improves a company’s bottom line by reducing its operating costs and minimizing regulatory risks.

Why ESG’s Importance is Growing

The similarities between the unprecedented effects of a pandemic and climate change have prompted investors to reevaluate their investment strategies. This has led them to favor investing in businesses that promote sustainable ESG practices.

After all, today’s society is dependent on both government and business. Businesses are responsible for providing jobs, generating wealth, protecting resources, and looking out for the consumer.

The amount of money invested in socially responsible investing in the US has nearly doubled in 2020, from $21.4 billion to $51.1 billion. This is up from only $5.4 billion in 2019.

In Asia, sustainable fund assets almost tripled to $36.7 billion in March 2021 excluding Japan.

The COVID-19 crisis has forced companies to make difficult decisions about business strategy, the well-being of their employees, and risk management.

How Can Companies Make Money by Being Sustainable?

Sustainability and profitability often seem at odds with one another, but that doesn’t have to be the case. In fact, more and more companies are finding that sustainability can be a key driver of profitability.

There are a number of ways that companies can make money by being sustainable.

One is by reducing their environmental impact. This can lead to cost savings in a number of areas, including energy, water, and waste. It can also help companies avoid environmental fines and penalties.

Another way companies can profit from sustainability is by appealing to eco-conscious consumers. There is a growing demand for sustainable products and services, and companies that can meet this demand can reap the financial rewards.

Finally, sustainability can help companies attract and retain top talent. Employees are increasingly looking for employers that share their values, and sustainability is often high on the list.

Companies that are able to implement sustainable business practices can reap a number of financial benefits. In today’s business world, being sustainable is no longer a luxury – it’s a necessity.

There are a lot of people out there who believe that environmental, social, and governance (ESG) investing will save the world.

And while that may be true, there are also a lot of companies out there that are still not implementing ESG standards into their business practices.

So, why is ESG important for companies?

First and foremost, ESG investing is important because it helps to protect the environment. By investing in companies that are working to reduce their environmental impact, you are helping to make a difference.

Second, ESG investing is important because it helps to improve social conditions. By investing in companies that are working to improve working conditions and provide better benefits for employees, you are making a difference.

And third, ESG investing is important because it helps to promote better governance. By investing in companies that are committed to good governance practices, you are helping to ensure that they are run in a way that is beneficial for all stakeholders.

ESG Benefits to Your Bottom Line

There are a number of benefits that a company can realize by implementing an ESG strategy, including improved financial performance, enhanced risk management, and increased attractiveness to investors.

There is a growing body of evidence showing that companies with strong ESG practices tend to outperform their peers financially.

A study by MSCI found that companies in the top quartile of ESG performance had an average return on equity that was 2.3 percentage points higher than companies in the bottom quartile.

Similarly, a study by S&P Global found that companies with strong ESG ratings had lower default rates and higher credit ratings than companies with weak ESG ratings.

In addition to financial benefits, implementing an ESG strategy can also help companies manage risk more effectively.

For example, companies that are able to reduce their carbon emissions will be less exposed to the risks associated with climate change.

And companies that have strong policies and practices in place to prevent and address human rights abuses will be less likely to face reputational damage or legal liabilities.

Finally, companies with strong ESG practices are often more attractive to investors. In a recent survey of institutional investors, 84% said that they consider ESG factors when making investment decisions.

And a growing number of investors are specifically looking to invest in companies that are making a positive contribution to society.

How to Create an ESG Policy for Your Business

The first step is to assess where your company stands on environmental, social, and governance (ESG) issues. You can do this by looking at your business practices and seeing where there is room for improvement.

Once you have a good understanding of your company’s ESG footprint, you can start developing policies and programs to improve your company’s ESG performance.

Communicating your company’s ESG policies to employees, shareholders, and other stakeholders is also important to ensure that everyone is on the same page and working towards the same goals.

FAQs About Why Is ESG Important for Companies

What is ESG and why it is important?

ESG stands for environmental, social, and governance. It is important for companies because it encompasses a broad range of issues that can affect a company’s long-term sustainability and profitability.

ESG factors can include a company’s carbon footprint, water usage, waste management practices, employee diversity and inclusion policies, human rights records, and corruption scandals.

Investors are increasingly interested in ESG factors when making decisions about where to allocate their capital.

They believe that companies with strong ESG profiles are more likely to be financially successful over the long term and less likely to experience negative surprises that could lead to financial losses.

Why is ESG important to organizational success?

ESG links to cash flow in five important ways:

- Facilitate top-line growth.

- Reduce costs.

- Minimize regulatory and legal interventions.

- Increase employee productivity.

- Optimize investment and capital expenditures.

Conclusion

Why is ESG important for companies? As we have seen, ESG is important for companies for a variety of reasons. It can help them to save money, attract talent, and appeal to the consumers of tomorrow. It is also good for the environment, society, and humanity at large.

We hope that this article has helped to show you why ESG is so important and that you will take steps to incorporate it into your own business. Thank you for reading!

{“@context”:”https:\/\/schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”What is ESG and why it is important?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

ESG stands for environmental, social, and governance. It is important for companies because it encompasses a broad range of issues that can affect a company’s long-term sustainability and profitability.

ESG factors can include a company’s carbon footprint, water usage, waste management practices, employee diversity and inclusion policies, human rights records, and corruption scandals.

Investors are increasingly interested in ESG factors when making decisions about where to allocate their capital.

They believe that companies with strong ESG profiles are more likely to be financially successful over the long term and less likely to experience negative surprises that could lead to financial losses. “}},{“@type”:”Question”,”name”:”Why is ESG important to organizational success?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

ESG links to cash flow in five important ways:

- \n\t

- Facilitate top-line growth.\n\t

- Reduce costs.\n\t

- Minimize regulatory and legal interventions.\n\t

- Increase employee productivity.\n\t

- Optimize investment and capital expenditures.\n

- Facilitate top-line growth.

- Reduce costs.

- Minimize regulatory and legal interventions.

- Increase employee productivity.

- Optimize investment and capital expenditures. “}}]}