As consumers become increasingly aware of environmental and social issues, they’re demanding that businesses take notice too. This has led to a boom in the area of environmental, social, and governance (ESG) research, with investors looking for ways to profit from this growing trend while also making a positive impact on the world around them. But what does an ESG analyst do?

The job of an ESG analyst is to conduct research and analysis on companies’ exposure to various environmental, social, and governance risks in order to support investment decision-making.

But it’s not as simple as just looking at whether or not a company is doing something good or bad – there’s a lot more nuance involved. For example, an analyst might look at how water-stressed a region is where a company operates, whether its products are harmful to the environment, how much waste it produces, its carbon footprint, its employee safety records, and many more.

Essentially, what does an ESG analyst do is try to get an understanding of how well-equipped a company is in dealing with these types of risks now and into the future.

This role requires both technical and soft skills. On the technical side, analysts need to have a good understanding of financial analysis and modeling and be comfortable working with large data sets. They also need to be able to communicate their findings clearly and concisely to a non-technical audience.

Table of Contents

What Does an ESG Analyst Do?

When it comes to impact investing, there are a variety of different types of analysis that go into making informed decisions. One such type of analysis is known as ESG analysis.

What does an ESG analyst do?

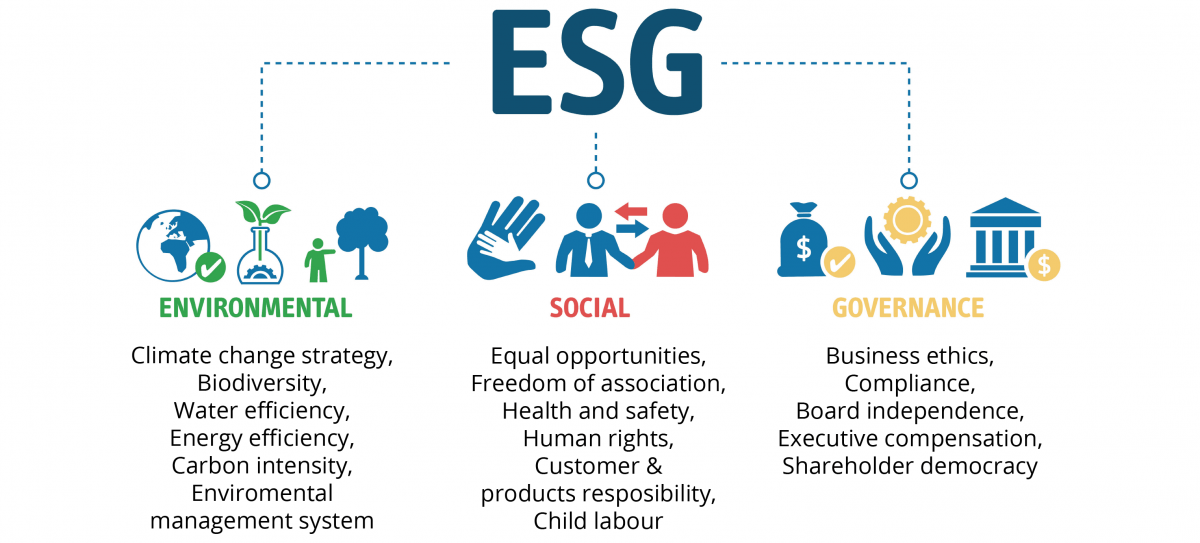

ESG stands for environmental, social, and governance analysis. ESG analysis looks at the non-financial aspects of a company in order to make investment decisions.

This type of analysis is often used in impact investing, as it allows investors to see beyond the financials of a company and get a better sense of its overall sustainability.

An ESG analyst is responsible for conducting this type of analysis. This can involve looking at a variety of different factors, such as a company’s carbon footprint, its employee retention rates, and its policies around things like diversity and inclusion.

By taking all of these factors into account, an ESG analyst can help investors make more informed decisions about where to invest their money.

The Role of an ESG Analyst

The role of an ESG analyst is becoming increasingly important as investors start to consider ESG factors when making investment decisions. This is because ESG factors can have a material impact on a company’s financial performance.

For example, a company that is not well-positioned to manage environmental risks may incur significant costs as a result of environmental regulations.

(Source)

(Source)

Similarly, a company that does not take into account the social impacts of its business may face reputational risks.

As an ESG analyst, you will need to have a strong understanding of the ESG landscape and the key issues that are important to investors.

You will also need to be able to effectively communicate your research and analysis to both internal and external stakeholders.

If you’re interested in a career as an ESG analyst, you should have a strong academic background in environmental science, social science, or business. You should also have excellent research and analytical skills.

Key Responsibilities of an ESG Analyst

When it comes to assessing the impact of a company’s actions on the environment, social issues, and corporate governance (ESG), an ESG analyst is key.

Here are three of the main responsibilities of an ESG analyst.

1. Research and Analysis

An ESG analyst is responsible for researching and analyzing a company’s ESG performance.

This includes looking at financial reports, news articles, and other data sources to identify ESG risks and opportunities.

2. Engagement

An ESG analyst also engages with companies to discuss their ESG performance.

This may include meeting with company management, attending shareholder meetings, and writing reports.

3. Rating and Ranking

An ESG Analyst will rate and rank companies based on their ESG performance.

This information is then used by investors to make informed investment decisions.

Skills and Attributes Required to Be a Successful ESG Analyst

As an ESG analyst, there are certain skills and attributes that will help you be successful in your role.

First and foremost, you must have a strong understanding of environmental, social, and governance (ESG) factors and how they can impact companies.

You will need to be able to research and analyze companies to identify potential risks and opportunities related to ESG factors.

Excellent communication and writing skills are essential in this role as you will be responsible for writing reports and presenting your findings to clients.

You must be able to work independently and be comfortable with ambiguity as ESG analysis can sometimes be a complex and ever-changing field.

Finally, it is important to have a passion for making a positive impact on the world around you, as ESG analysis can be used to help drive positive change for companies and society as a whole.

How to Become an ESG Analyst

If you want to make a difference in the world of finance and sustainability, then a career as an ESG analyst may be for you.

The first step to becoming an ESG analyst is to earn a bachelor’s degree in business, economics, or a related field. Many ESG analysts also have a master’s degree in business administration (MBA) or a master’s degree in sustainable development.

Once you have your degree, you’ll need to gain experience in the financial sector, preferably with a focus on sustainability. You can do this through internships, entry-level jobs, or even volunteer work.

Once you have the necessary education and experience, you’ll need to become familiar with the tools and methods used by ESG analysts. There are many online resources that can help you with this and many companies offer training programs for new analysts.

Once you’re up to speed on the basics, you can start looking for jobs.

Many ESG analysts work for financial institutions but there are also opportunities with NGOs, think tanks, and consulting firms.

FAQs About What Does an ESG Analyst Do

How do I become an ESG analyst?

- Bachelor’s degree in finance, commerce, business, environmental science, or a related discipline.

- 1-2 years of working experience in ESG research, financial services, or a related discipline.

- A developed interest in sustainability issues within the financial industry.

What skills do you need for ESG?

- Ability to collaborate and work with investment teams.

- Solid communication skills.

- Knowledge of all relevant ESG regulations.

- A strong value for ethics.

- Analytical skills.

Do ESG jobs pay well?

The national average salary for jobs that include the skills of the Environmental, Social, and Governance (ESG) framework and methodology is $181,476.

What are ESG interview questions?

- Do ESG criteria help frame the strategy’s investment universe?

- How do ESG criteria impact investment decisions and portfolio construction?

- How do ESG metrics impact the strategy’s risk management?

- What is the engagement and proxy voting strategy?

Conclusion

What does an ESG analyst do? An ESG analyst is a key player in the investment world, responsible for conducting research and analysis on environmental, social, and governance (ESG) issues to support investment decision-making.

With the world changing rapidly and new generations of consumers becoming increasingly aware of the environmental and social issues facing our planet, being an ESG analyst is an important role with plenty of opportunity for growth.

If you have strong technical skills in financial analysis and modeling as well as being able to communicate your findings clearly, then a career as an ESG analyst could be perfect for you!

{“@context”:”https:\/\/schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”How do I become an ESG analyst?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

- \n\t

- Bachelor’s degree in finance, commerce, business, environmental science, or a related discipline.\n\t

- 1-2 years of working experience in ESG research, financial services, or a related discipline.\n\t

- A developed interest in sustainability issues within the financial industry.\n

- Bachelor’s degree in finance, commerce, business, environmental science, or a related discipline.

- 1-2 years of working experience in ESG research, financial services, or a related discipline.

- A developed interest in sustainability issues within the financial industry. “}},{“@type”:”Question”,”name”:”What skills do you need for ESG?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

- \n\t

- Ability to collaborate and work with investment teams.\n\t

- Solid communication skills.\n\t

- Knowledge of all relevant ESG regulations.\n\t

- A strong value for ethics.\n\t

- Analytical skills.\n

- Ability to collaborate and work with investment teams.

- Solid communication skills.

- Knowledge of all relevant ESG regulations.

- A strong value for ethics.

- Analytical skills. “}},{“@type”:”Question”,”name”:”Do ESG jobs pay well?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

The national average salary for jobs that include the skills of the Environmental, Social, and Governance (ESG) framework and methodology is $181,476. “}},{“@type”:”Question”,”name”:”What are ESG interview questions?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

- \n\t

- Do ESG criteria help frame the strategy’s investment universe?\n\t

- How do ESG criteria impact investment decisions and portfolio construction?\n\t

- How do ESG metrics impact the strategy’s risk management?\n\t

- What is the engagement and proxy voting strategy?\n

- Do ESG criteria help frame the strategy’s investment universe?

- How do ESG criteria impact investment decisions and portfolio construction?

- How do ESG metrics impact the strategy’s risk management?

- What is the engagement and proxy voting strategy? “}}]}