As a business owner, you know that ESG credit is important. But what you may not realize is that your company’s ESG rating can also have a big impact on your bottom line.

Here’s what you need to know about ESG credit and why it matters for your business.

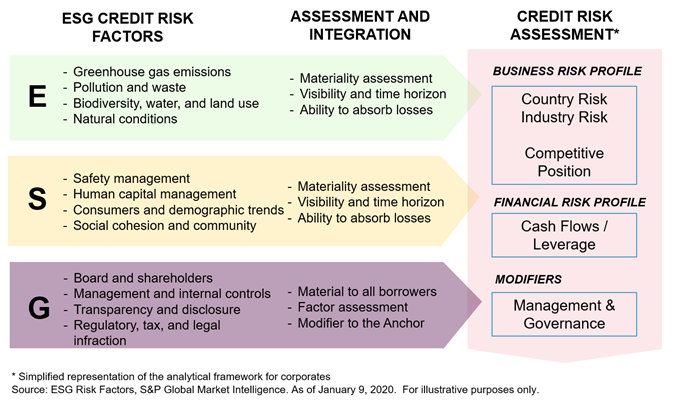

ESG stands for environmental, social, and governance. And companies with strong ratings in these areas are often seen as more responsible and sustainable than those with low ratings.

As a result, they tend to enjoy lower borrowing costs and higher valuations from investors.

In other words, good ESG scores can save your company money – which is always good for business!

Why does my company need good ESG ratings?

Table of Contents

What is ESG Credit?

ESG credit is a type of financing that allows companies to access capital based on their environmental, social, and governance (ESG) performance.

This type of financing can be used for a variety of purposes, including investments in renewable energy, social housing, and sustainable agriculture.

ESG credit is becoming increasingly popular as more investors are looking to put their money into companies that are making a positive impact on the world. This type of financing can help companies scale up their operations and make a bigger impact.

If you’re looking for a way to invest in companies that are making a difference, ESG credit is a great option.

The Importance of ESG Credit

ESG credit is a type of credit that is extended to a company or individual based on their environmental, social, and governance (ESG) practices. In other words, this type of credit is given to those who have demonstrated a commitment to sustainability.

There are a number of reasons why ESG credit is important.

For one, it helps to encourage sustainable practices. When companies and individuals are given credit for their sustainable practices, it provides an incentive for them to continue these practices.

Additionally, ESG credit can help to finance sustainable projects. By giving companies and individuals credit for their sustainable practices, banks and other financial institutions are more likely to invest in these projects. This, in turn, can help to create a positive feedback loop where sustainable practices are encouraged and financed.

Finally, ESG credit can help to create a level playing field. Currently, there is a disconnect between the financial incentives that companies and individuals receive and the environmental and social impacts of their actions. ESG credit can help to close this gap by providing financial incentives that are aligned with sustainable practices.

How to Get an ESG Rating

When it comes to responsible investing, one of the most important considerations is a company’s ESG rating.

ESG stands for environmental, social, and governance, and refers to the three main pillars of sustainability.

A company’s ESG rating is a measure of its performance in these three areas.

There are a number of different organizations that provide ESG ratings, and each one has its own methodology.

However, there are some general tips that can help you get a good idea of a company’s ESG rating.

First, you can look at a company’s website and see if they provide any information on their ESG rating. Many companies will list their rating on their investor relations page or in their annual report.

Second, you can search for news articles or analyst reports that mention a company’s ESG rating. This can be a good way to get an idea of how the company is perceived by others.

Third, you can contact the company directly and ask for their ESG rating. This is usually the best way to get an accurate and up-to-date rating.

Finally, you can use an online ESG rating tool. There are a number of different tools available, and they can provide you with a company’s ESG rating based on a variety of different factors.

Once you have a company’s ESG rating, you can use it to help you make responsible investing decisions.

For example, you might choose to invest in companies with high ESG ratings, or you might avoid companies with low ESG ratings.

However, it’s important to remember that an ESG rating is just one factor to consider when making investment decisions.

You should also look at a company’s financial performance, business model, and other factors before making any decisions.

Advantages of Having Good ESG Ratings

As an individual or company, it’s important to be aware of your ESG rating. Your ESG rating is a reflection of how well you score on environmental, social, and governance issues.

A high ESG rating means that you’re doing well on these important issues, while a low ESG rating means that you have some work to do.

There are many advantages to having a high ESG rating.

For one, it shows that you’re committed to being a responsible and sustainable business. This can help you attract and retain customers and employees who are looking for companies that share their values.

A high ESG rating can also lead to lower costs, as you’ll be able to take advantage of green initiatives and other cost-saving measures.

(Source)

Of course, there are disadvantages to having a low ESG rating.

For one, it can be difficult to attract and retain customers and employees. It can also lead to higher costs, as you may be required to make changes to your business in order to improve your rating.

Ultimately, whether or not you have a high or low ESG rating is up to you. If you’re committed to being a responsible and sustainable business, then you should aim for a high rating. If you’re not as concerned about these issues, then a low rating may be fine.

Either way, it’s important to be aware of your ESG rating and what it means for your business.

FAQs About ESG Credit

What is an ESG credit?

An ESG score is a measure that assesses a company’s sustainability, taking into account environmental factors, social issues, and corporate governance. These scores are not typically included in a traditional financial statement.

Do credit unions have an ESG score?

An ESG approach to business means that credit unions take explicit steps to consider both the risks posed by environmental factors and ways to leverage those factors in their strategies, planning, and operations. Credit unions understand the risks and opportunities that climate change presents.

What is the ESG relevance score?

The ESG scores are created by a team of analysts who determine their relevance to the credit rating. They are based on specific sectors and entities.

Conclusion

There are many reasons why your company should care about its ESG ratings. Not only can it save you money, but it also shows that you’re committed to being a responsible and sustainable business.

That’s good for both your bottom line and your reputation. So if you haven’t already, make sure to start paying attention to your company’s ESG credit rating – it could be the key to success in the years ahead.

{“@context”:”https:\/\/schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”What is an ESG credit?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

An ESG score is a measure that assesses a company\u2019s sustainability, taking into account environmental factors, social issues, and corporate governance. These scores are not typically included in a traditional financial statement. “}},{“@type”:”Question”,”name”:”Do credit unions have an ESG score?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

An ESG approach to business means that credit unions take explicit steps to consider both the risks posed by environmental factors and ways to leverage those factors in their strategies, planning, and operations. Credit unions understand the risks and opportunities that climate change presents. “}},{“@type”:”Question”,”name”:”What is the ESG relevance score?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

The ESG scores are created by a team of analysts who determine their relevance to the credit rating. They are based on specific sectors and entities. “}}]}