As more and more investors are looking to put their money into companies that align with their values, it’s becoming increasingly important for businesses to consider their environmental, social, and governance (ESG) performance. But how to measure ESG performance for each company?

First, determine what data you need to collect in order to assess your progress against your ESG goals. This might include information on emissions reductions, employee satisfaction levels, or community engagement programs.

Once you have this data gathered, take a look at how other companies in your industry are measuring up against their peers when it comes to ESG performance.

Finally, conduct a cost-benefit analysis of different reporting frameworks to see which one makes the most sense for your business. Let us explore further how to measure ESG performance for businesses.

Table of Contents

Define ESG Performance Goals and Objectives

When it comes to setting performance goals and objectives, ESG is no different than any other business metric. You need to first understand what you want to achieve and then set specific, measurable goals that will help you get there.

The first step is to understand the different aspects of ESG and how they relate to your business.

ESG covers a broad range of topics, from environmental stewardship to social responsibility to corporate governance.

Once you have a good understanding of what ESG means for your business, you can start to set some specific goals.

For example, if you want to improve your environmental performance, you might set a goal to reduce your carbon footprint by 10% over the next year.

Or if you want to improve your social performance, set goals that provide fair and safe working conditions for all employees.

Whatever goals you set, it’s important to make sure they are specific, measurable, achievable, relevant, and time-bound (SMART). This will help you monitor your progress and ensure you are on track to achieving your goals.

Once you have your ESG performance goals in place, you need to put a plan in place to achieve them.

This will involve setting targets and action items and putting the right systems and processes in place to track progress.

With a clear understanding of what you want to achieve and a plan to get there, you’ll be well on your way to measuring and improving your ESG performance.

Determine the Right Data to Collect

There’s a lot of data out there. How do you know what data to collect when trying to measure ESG performance?

1. Define Your Goals

What are you trying to learn or accomplish?

2. Do Your Research

What data is already out there?

3. Consider All Options

What are the pros and cons of each data source?

4. Make a Plan

How will you collect the data?

When?

How often?

5. Test and Refine

As you collect data, you may find that some of it aren’t as useful as you thought. That’s okay! Just adjust your plan and keep going.

Assess Which Companies Are Measuring Up Against Their Peers

As more and more companies are vowing to take climate change seriously and make sustainability a priority, it’s more important than ever to know which ones are putting their money where their mouth is.

This can be difficult to assess, however, as different companies have different ways of measuring their progress.

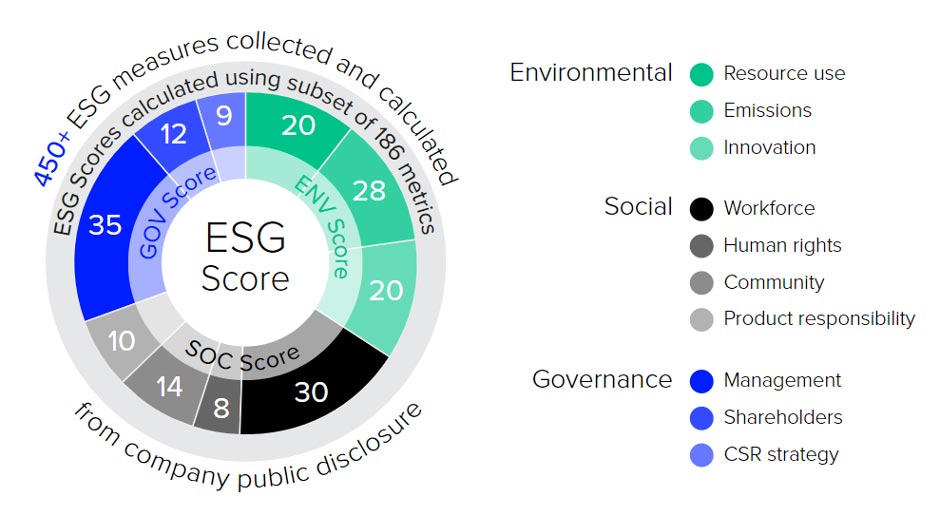

One way to measure a company’s dedication to sustainability is to look at its ESG performance.

This metric looks at how companies are doing in terms of environmental friendliness, social responsibility, and good governance.

(Source)

(Source)

How to measure ESG performance?

There are a few different ways to measure a company’s ESG performance.

One is to look at their disclosure score, which measures how much information they make public about their sustainability efforts. The higher the score, the more transparent the company is being about its progress.

Another way to measure ESG performance is to look at a company’s carbon intensity. This measures the amount of carbon dioxide that a company emits for every unit of production. The lower the carbon intensity, the better.

Finally, you can also look at a company’s sustainability rating. This is a score that is given to companies by third-party organizations that assesses how well they are doing in terms of sustainability.

When you’re trying to assess which companies are measuring up against their peers, it’s important to look at all of these different metrics. By doing so, you can get a more well-rounded picture of which companies are truly dedicated to sustainability.

Conduct a Cost-Benefit Analysis of Various Reporting Frameworks

When it comes to measuring environmental, social, and governance performance, there are a number of different reporting frameworks to choose from. A cost-benefit analysis can help you determine which framework is right for your organization.

The first step is to calculate the costs associated with each framework. This includes the cost of data collection, analysis, and reporting. You also need to consider the costs of any external verification that may be required.

Next, you need to quantify the benefits of each framework. This can include the ability to access capital, improved risk management, and enhanced reputation.

Once you have calculated the costs and benefits of each framework, you can conduct a cost-benefit analysis to see which one is the most advantageous for your organization.

This will help you make an informed decision about which framework to use to measure ESG performance.

Weigh the Pros and Cons of Integrating ESG Into Traditional Financial Metrics

There are a number of ways to measure ESG performance, but each has its own set of pros and cons.

One popular method is to use traditional financial metrics such as return on investment (ROI) or earnings per share (EPS).

While this approach can be helpful in getting a general sense of a company’s financial health, it doesn’t give a complete picture of its ESG performance.

Another approach is to use specific ESG indicators, such as carbon emissions or water usage. This can be a more accurate way to measure a company’s ESG performance, but it can be difficult to find reliable data on some of these indicators.

Many investors use a combination of both financial and ESG indicators to get a more complete picture of a company’s performance. This approach has the advantage of being both more accurate and more comprehensive, but it can be more time-consuming to gather all the necessary data.

No matter which approach you choose, it’s important to remember that no single metric can give you a perfect picture of a company’s ESG performance.

Instead, it’s best to use a variety of different metrics to get a more complete understanding of a company’s environmental, social, and governance practices.

FAQs About How to Measure ESG Performance

How do you measure the success of ESG?

Investors may compare their ESG score to:

- Peers managing comparable portfolios.

- A common benchmark index.

- The investors’ own history.

What are KPIs for ESG?

ESG Key Performance Indicators (KPIs) are metrics that measure a firm’s impact on the environment, society, and corporate governance.

Examples include greenhouse gas emissions, energy consumption, water usage, waste generation, employee safety and satisfaction, supplier diversity, and community engagement.

Can ESG be measured?

There are a number of ways companies can report their environmental, social, and governance (ESG) practices. A variety of different investors and other businesses use these reports to make investment decisions, select suppliers and inform other important decisions.

Conclusion

There is no one-size-fits-all answer to the question of how to measure ESG performance. However, by following some simple tips – such as defining your goals and objectives, collecting the right data, and benchmarking against other companies in your industry – you can get a good sense of where your business stands on environmental, social, and governance issues.

{“@context”:”https:\/\/schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”How do you measure the success of ESG?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

Investors may compare their ESG score to:

- \n\t

- Peers managing comparable portfolios.\n\t

- A common benchmark index.\n\t

- The investors’ own history.\n

- Peers managing comparable portfolios.

- A common benchmark index.

- The investors’ own history. “}},{“@type”:”Question”,”name”:”What are KPIs for ESG?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

ESG Key Performance Indicators (KPIs) are metrics that measure a firm\u2019s impact on the environment, society, and corporate governance.

Examples include greenhouse gas emissions, energy consumption, water usage, waste generation, employee safety and satisfaction, supplier diversity, and community engagement. “}},{“@type”:”Question”,”name”:”Can ESG be measured?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”

There are a number of ways companies can report their environmental, social, and governance (ESG) practices. A variety of different investors and other businesses use these reports to make investment decisions, select suppliers and inform other important decisions. “}}]}